Expat tax services from trusted tax experts

Why work with Taxes for Expats

Deep expertise

Personalized service

Exceptional accuracy

Trusted by 50,000+ clients

Mentioned in

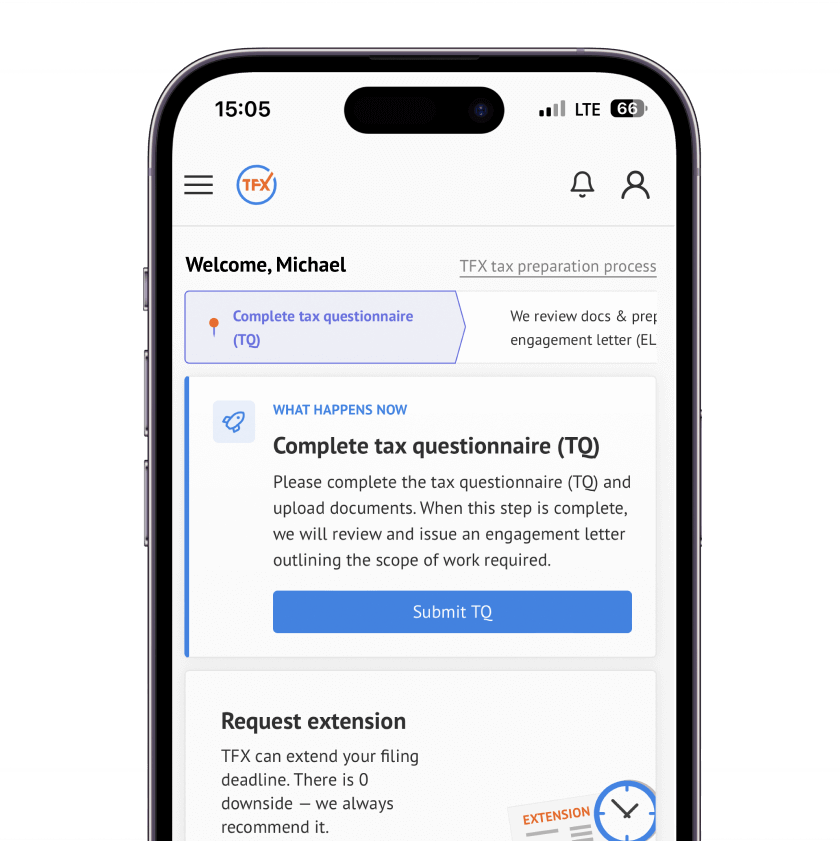

How we work

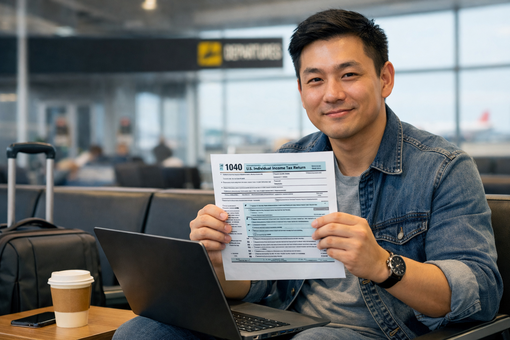

Expert, human accountant working on your case

Professionals who care & stand ready to answer your questions. Experienced humans who understand expat taxation in and out.

80+ accredited CPAs, EAs, JDs.

Real people, just like you.

50,000+ clients, 193+ countries, 4,000+ reviews

Frequently asked questions

At Taxes for Expats, we help individuals and businesses with US tax obligations, including:

- Americans living in the US or abroad

- Dual citizens with US passports

- Green card holders

- Accidental Americans

- Non-US citizens with US tax requirements

- Digital nomads

- US retirees living overseas

- Businesses with US tax requirements

No matter your situation, our team has the expertise to guide you through your US tax filing with confidence.

We offer Federal Income Tax Return and Expanded Income Bundles tailored to your specific tax filing needs. For a detailed overview of our fees, please visit: Our Fees.

To find out which documents and information are required for your tax preparation, please check our guide here: Tax Documents Needed.

Yes, we stand behind the work we do. If the IRS questions a return prepared by us, we will review the letter and advise you on the necessary steps. For more information, see: Received IRS Letter.

We offer free support via phone, email, and chat. For more information on our support options, please visit: Support Options Overview.

Absolutely. TFX has been preparing US expat taxes for over 25 years and is well-versed in the tax laws applicable to US expats worldwide.

Absolutely! If you’re a non-US citizen with US tax obligations – whether due to income earned in the US, business dealings, or other connections – we can help. Our team understands the complexities involved and will guide you through the necessary filings with ease.

We prepare a wide range of forms, including 1040/1040NR, Form 5471, Form 5472 with Form 1120, and many more. For a full list of forms we handle, please visit: Forms We Prepare.

Yes, we can file an extension for you at no additional cost. However, we require a $50 retainer, which will remain as a credit on your account for future TFX services.

We only work with seasoned CPAs or EAs who each have at least a decade of experience in the field. We don’t employ junior staff.

Our goal is to complete each tax return within fifteen (15) business days per filing year. We prioritize quality and accuracy, with every return undergoing a thorough review by both a preparer and a supervising CPA or EA.

If you're unsure whether you need to file US taxes, we can help you determine your filing requirements. Even if you're living abroad or have limited US ties, you may still have an obligation to file. We’ll review your specific situation and provide personalized guidance.

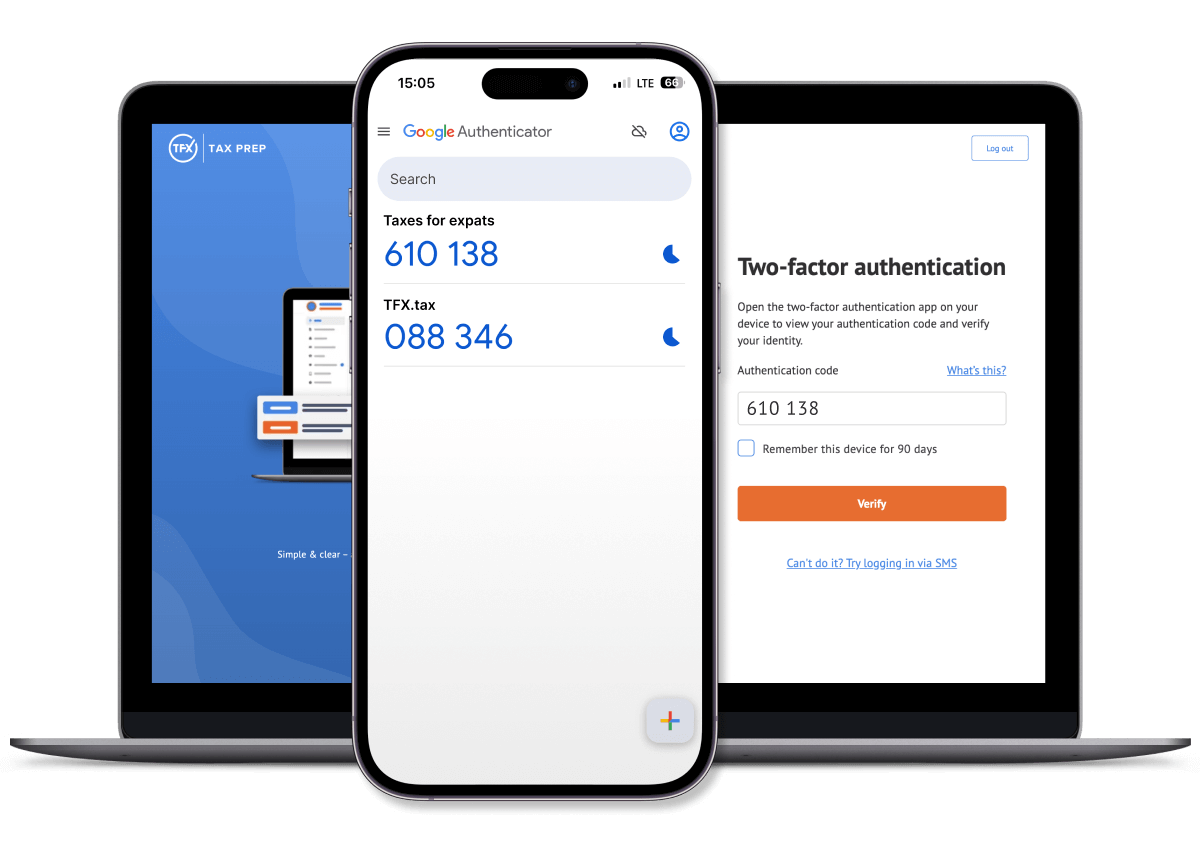

Top-tier security protocols to protect your information

All sensitive data is encrypted at rest and in transit using cutting-edge encryption protocols (AES-256). For added protection, we implement two-factor authentication (2FA), delivering an extra layer of security to safeguard your information against unauthorized access.

Articles & tax guides

View all →Yes, minors typically get taxes taken out of their paycheck just like adults if they earn more than the standard deduction. For 2026, minors must file taxes if they earn more than $16,100 in wages. However, many teens can claim exempt status on Form W-4 if they expect to owe no federal tax, preventing withholding. Minors can get refunds by filing...

Millions of Americans pack up and start over abroad every year – the State Department estimates about 9 million US citizens live outside the country. Many US citizens living overseas don’t realize the IRS can still expect a Form 1040, even when income is earned far from the US and daily life feels settled elsewhere. When pri...

The physical presence test is an IRS requirement to qualify for the Foreign Earned Income Exclusion (FEIE). You must be physically present in a foreign country for at least 330 full days during any 12-month period to exclude up to $130,000 of foreign earned income from US taxation in the 2025 tax year. This test is one of two paths to q...

US tax rules, particularly those involving foreign corporations and Form 5471, can be complex and overwhelming for taxpayers. In this article, we’ll break down what Form 5471 is, who is required to file it, the penalties for non-compliance, and share tips to keep you on track with the IRS. What is Form 5471? ...

Living abroad doesn’t automatically free U.S. citizens from taxes. While most Americans overseas owe little or no federal tax, understanding your obligations and available tax benefits is key to avoiding double taxation and maximizing deductions and credits. This article is brought to you by Taxes for Expats (TFX) – a to...

Planning to give up your US citizenship or green card? The first question most people ask is: Will I have to pay exit tax? Quick answer: Most people won’t owe an exit tax. You only owe if you are classified as a covered expatriate, which generally refers to individuals who meet certain wealth, tax liability, or co...